Passive investing - the chutes and ladders path to prosperity

Primer - What is passive investing?

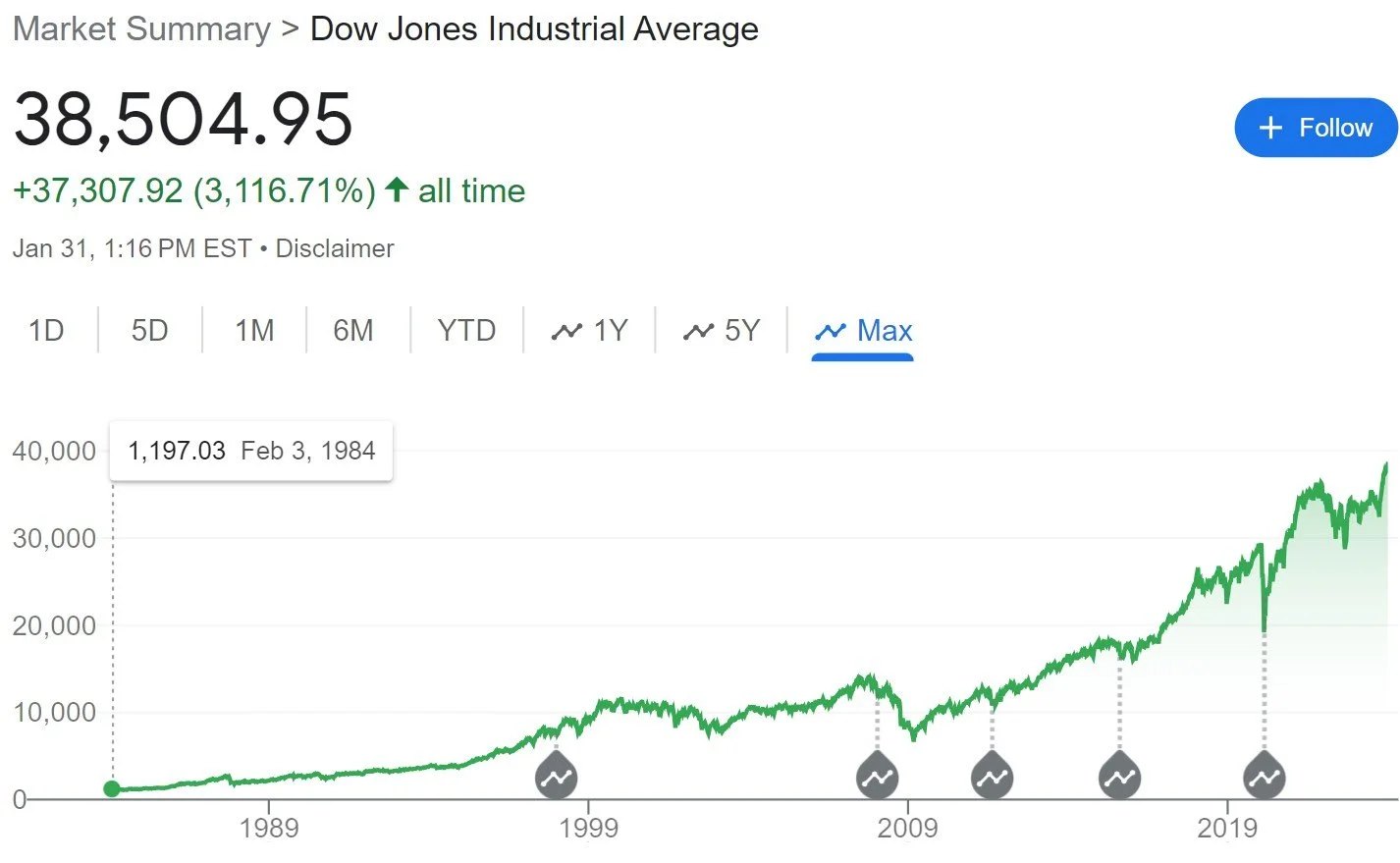

How does this graph feel to you?

Unless we’re talking about the size of your waistline or your cost of living once the kids move out, this graph probably doesn’t feel good at all. We’re conditioned to know that this line likely represents something we hope to go up. Obviously, based on the title of this article, we’re talking about your investments.

With that in mind, take another glance and think about your portfolio. Now, take another look and think about the specific goals for your portfolio, or rather the specific goals of each part:

The 401k meant for retirement.

The 529 meant for your child’s education.

The brokerage account earmarked as a down payment on a home.

As if you didn’t feel bad enough thinking about this loss in your portfolio, it stings much worse when connected to your hopes and dreams. After all, these dreams are the reason you’re making these investments to begin with. Unless your goal is to die with as much money as possible (no judgement), then the idea of losing money in your portfolio will hurt worse than simply the money lost. This is the representation of your life; and it’s going downhill.

Playing in traffic

The feelings associated with investment loss are as real as the losses themselves. They hurt and they persist. They hit in real time; in the present. They suddenly cause uncertainty about how you will ever achieve your goals or if you will achieve them at all.

These feelings can be intense, but that is not the crucial part. The important part of these feelings is that they inspire us to act. Fight or flight. Don’t just stand there, do something. Panic. Fix it. Stop the Bleeding. Do it now.

These reactions can be very helpful when you’re fighting for your life. However, when it comes to the world of investing, avoiding these panicked calls to action can be the difference between handling a bad situation and making it permanent.

Think back to the last time you were in traffic. I’m talking about a properly clogged up traffic jam. Every few seconds your line lurches forward a few feet and comes to a stop. The lane to your right does the same. The lane to your left seems to be stuck, but hey, it seems like those two cars were just behind you. A few more feet. Now it’s the right lane that’s moving. Now both of the lanes to either side start to move. You’re still stuck. You signal and merge left.

You know what’s next. You’re stuck. The lane you just exited begins to move slowly… then faster. You’re still stopped. I would continue this example, but you know how it plays out. Moving in and out from lane to lane, only to feel like you’re falling further behind the flow.

How to get ahead – forget about the race

In 2014, Business Insider published an article that has since grown wildly in popularity. It is called “Fidelity Reviews Which Investors Did Best And What They Found Was Hilarious”. Feel free to go read the short article, but I’ll spoil it for you. In the pursuit of discovering the secret to investment success, Fidelity discovered that the investors that had the highest performance returns were those who had forgotten they had an account!

Later, further illustrating the point is a graph showing the dismal return from the average investor compared with the multitude of indexes that beat them. Another spoiler: almost all the indexes beat them. Salt in the wound: the average investor barely beat inflation. Ouch.

What about the best performing investors? Of course there is no investor more well known than Warren Buffett. What does he think about it? According to this 2022 article in the Motley Fool, Warren preaches the virtues of time in the market. To summarize, holding quality investments for a long period of time is the key to growing wealth. Probably easier said than done, right? To highlight that point, Buffett had to wait a long time to realize the majority of his wealth, earning 99% after his 50th birthday. (PS, he started when he was a child). Seems as though Mr. Buffett has been riding in the same lane for over 80 years.

The bigger picture

The 80+ investment career of Warren Buffett is easy to covet. His strategy may seem simple (and in principle it is), but in practice it is not as easy as it appears.

Looking back to the chart at the beginning of this article, remember the feelings we discussed? Dread, fear, panic, and FOMO. They all are designed to help you make quick decisions to survive. Do you suppose Warren Buffett faced these moments? Undoubtedly he did and many more over the course of his long investment career. Now, consider this graph:

Ahh, much better. The Dow Jones has returned an average of 11.86% since 1992. Now that is an investment worth making!

But, as I suspect you might have noticed, while the Dow Jones has no doubt been a solid investment over the past 22 years, the graph at the beginning of the article was snipped directly from this one. That’s right. That small snapshot represented the period of time leading up to and including the crash of 2008. If you remember that downturn as I do, it was filled with many months of uncertainty and dread. It was slow and the losses kept compiling each day. We weren’t hit with the loss all at once, it was a daily existence for a long time.

It was difficult to hold on for the ride at that time. Losses were piling up and the urge to “change lanes” was strong. Do something. Now. Fix it.

Now that we have the bigger picture, that year suddenly doesn’t seem so dire. It was just a hiccup in an otherwise robust 22 year run.

Chutes and Ladders

I used to play chutes and ladders with my children. It is such a great game to play with kids. Simple to learn and conceive. Exciting ups and downs, but cleverly designed to eventually progress to “100”. The dramatic shifts in luck are not a bug of the game, but rather a feature. They are the random swoons and swells that provide the excitement, all with the presumed promise of making it to the end (at some point).

I’m sure you know where I’m going with this. This is such a great example of how passive investing works. Of course the random ups and downs of the game correlate nicely with the idea of investing, as well as the eventual progress up towards victory. But that isn’t why it is such a good metaphor. It is a good metaphor because it is simple.

Roll the dice (make a deposit). The game piece goes up or down, forward or back. Roll the dice again (make another deposit). Oops, chutes (correction in the market). Roll the dice, move forward, etc. Over and over again this repeats and you slowly make your way up the volatile road. Many detours along the way but, just as the graph above, slowly moving your way towards your goal.

It always works, at least it always has. Play the game, don’t quit, don’t switch lanes too often, and by all means don’t flip the game board over.