Feel better about your money

Services for Individuals and Families

Ongoing Planning Relationships

EVERMAN TOTAL LIFE DESIGN - The complete Financial Concierge

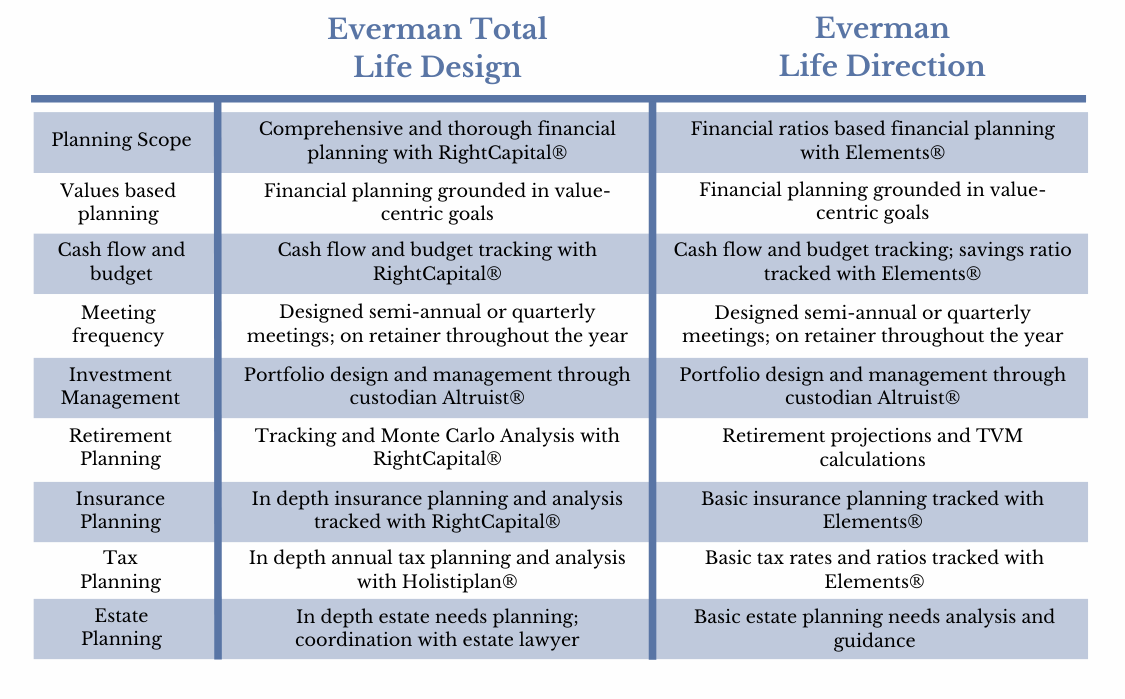

This offering provides clients with a comprehensive financial planning experience. Total Financial Life Design combines the broadest scope of Everman consultation, culminating in an ongoing advisor/client relationship. This relationship is anchored in the financial planning process and intended for clients with investable funds, evolving life events, and/or within 15 years of retirement. Clients receive an initial complete financial plan along with quarterly adjustments and ongoing advice in estate planning, insurance planning, risk assessment, portfolio allocation, portfolio management, tax strategies, and cash flow/budgeting management

1.0% AUM / Annual minimum applies*

EVERMAN LIFE DIRECTION - Financial Planning with a Lighter Touch

Similar to Total Financial Life Design, Financial Life Direction provides comprehensive financial planning in an ongoing advisor/client relationship. This relationship is anchored in the financial planning process and intended for younger clients or those with less complex situations. A lower minimum fee reflects the streamlined nature of the services provided. Just as Total Life Design, clients are onboarded in a comprehensive manner followed by quarterly adjustments and ongoing advice. Planning is focused on financial ratios along with basic forecasts and adjustments. Also included are risk assessment, portfolio allocation, portfolio management, and cash flow/budgeting management. Estate planning, insurance planning, and tax strategies are limited to less complex situations.

1.0% AUM / Annual minimum applies*

Ongoing Planning Relationships Compared

One Time / Limited Services

ONE TIME ENGAGEMENT - Financial Snapshot and Direction

This package provides a complete financial analysis and plan based on current financial standing and goals. Similar to the Everman Total Financial Life Design, this offering is comprehensive in nature, foregoing the ongoing management and planning. Follow-up meetings and adjustments are included within a 12-month time frame. This product is intended for households within various wealth accumulation stages, near or in retirement.

One-time fee starting at $4,470**

HOURLY ENGAGEMENT

Hourly services are available to Everman clients to serve one-off needs or add-ons to standard packages.

Fee: $320/hr***

* charged quarterly in arrears

** charged over 4 quarters in arrears

*** 50% down payment, remainder on completion

Services for Businesses

EVERMAN 401K MANAGEMENT - Retirement solutions for your business

Everman Prosperity provides 401K, Solo 401K, and Safe Harbor 401K solutions to meet the needs of your business, enhance your compensation model, and provide powerful value-centric guidance for your employees. This offering is nested in the heart of the Everman experience, beginning with the financial considerations of your company and amplified with an individual touch for each employee. Each participant is provided with individual meetings, a custom Investment Policy Statement, annual updates, and on-demand guidance to meet their changing needs.

0.40% AUM* / One time onboarding fee (negotiable)

“The plan is nothing, planning is everything”

— Dwight D Eisenhower